AIFMD II: Comprehensive Overview, Key Changes & Implications

- Antonis Hadjicostas

- Mar 1

- 4 min read

Updated: Mar 17

Background of AIFMD II

The Alternative Investment Fund Managers Directive (AIFMD) has undergone substantial revisions with the introduction of AIFMD II, aimed at enhancing regulation and investor protection within the European Union's financial landscape. This article delves into the significant changes introduced by AIFMD II, their implications for fund managers, and the expected impact on the investment sector.

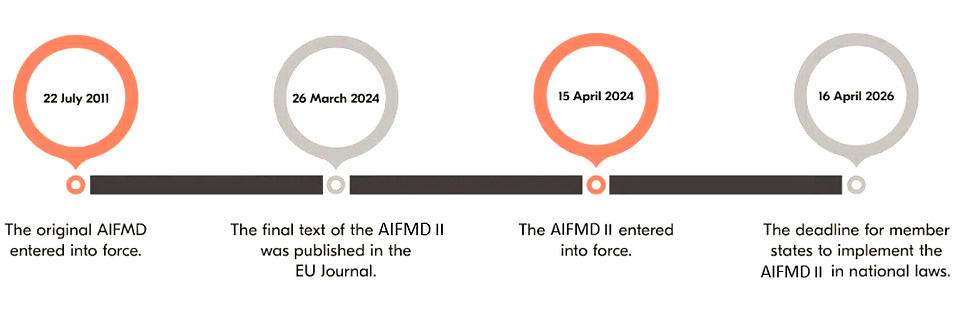

Key Time milestones

On November 25, 2021, the European Commission unveiled proposals to amend the AIFMD, followed by a series of negotiations involving the Council of the EU and the European Parliament. After extensive discussions, a provisional agreement on AIFMD II was reached in July 2023. The final text was published in the Official Journal of the EU on March 26, 2024, with an implementation date of April 15, 2024. Member States have until April 16, 2026, to transpose these provisions into national law.

Major Changes in AIFMD II

Delegation Framework

AIFMD II retains the existing delegation structure but enhances the requirements for oversight and reporting:

Supervision Enhancements: AIFMs must notify their national competent authority (NCA) when delegating functions to third parties. This requirement ensures that supervisory bodies maintain updated information on delegation arrangements.

Expanded Liability: The liability of AIFMs extends to include not only core delegated functions but also ancillary services, reinforcing the need for careful selection and monitoring of delegates.

Clarification on Marketing: The directive clarifies that marketing functions performed by distributors do not constitute delegation, alleviating some industry concerns.

Key Requirements for Delegation

Qualified Delegates: AIFMs must ensure that delegates are adequately qualified to perform delegated functions and that they are monitored effectively.

Data Reporting: AIFMs are required to provide detailed information about the percentage of assets subject to delegation, although this data will not serve as an evidential indicator for assessing the adequacy of risk management.

Authorisation Requirements

The authorisation process has been modified to demand more detailed disclosures from AIFMs:

Granular Information: AIFMs must provide extensive details about the individuals conducting business, delegation arrangements, and resources allocated for portfolio and risk management tasks.

Partial or Full Delegation: AIFMs must specify whether their delegation arrangements are partial or full, enhancing transparency for regulatory oversight.

Reporting Obligations

AIFMD II introduces comprehensive reporting requirements designed to enhance transparency and regulatory oversight:

Detailed Risk Profiles: AIFMs are required to report on various risk aspects, including market, liquidity, counterparty, and operational risks, as well as total leverage employed by the AIF.

Delegation Specifics: AIFMs must disclose information about the number of resources allocated for portfolio management, a list of delegated activities, and the start and end dates for delegation arrangements.

Disclosure to Investors

The revised directive places a strong emphasis on investor transparency:

Enhanced Disclosure: AIFMs must provide more detailed information regarding risks, fees, and investment nature both prior to and periodically throughout the investment period, ensuring investors are well-informed.

New Loan Origination Regime

AIFMD II introduces a new framework for loan origination, which is expected to significantly impact investment strategies and operations within AIFs. The updated Loan Origination regime within AIFMD II introduces several significant modifications:

Lending Passport: A major feature is the introduction of a lending passport, allowing for greater mobility in loan origination across the EU.

Leverage Limits: New leverage restrictions have been established, capping closed-ended funds at 300% and open-ended funds at 175%. These limits may pose challenges for funds engaged in substantial loan origination activities.

Applicability: The regime specifically targets EU full-scope AIFMs managing funds involved in loan origination, with additional requirements for those significantly engaged in this activity.

Flexibility: Interestingly, the regime allows for both closed-ended and open-ended structures for loan-originating AIFs, providing some operational flexibility.

Risk Retention: A new requirement mandates that AIFMs retain 5% of the risk associated with loans, which aligns with existing EU regulations but is a novel application in the context of straightforward lending.

National Implementation: As AIFMD II functions as an EU Directive, it must be integrated into national laws, which could lead to variations in implementation. Member States may also enhance their frameworks beyond the EU baseline, a practice known as "gold-plating."

Non-EU Managers Exclusion: Notably, the loan origination regime does not extend to non-EU managers operating in the EU, potentially placing them at a regulatory disadvantage compared to their EU counterparts.

The above underscores the importance of closely monitoring the implementation of AIFMD II, especially as it pertains to loan origination, as it may significantly influence market practices and regulatory compliance for fund managers.

Upcoming Regulatory Guidelines / Technical Standards

Implications for Fund Managers

The amendments brought forth by AIFMD II will necessitate substantial adjustments in fund management practices:

Increased Compliance Requirements: Fund managers will need to invest in compliance and reporting infrastructure to meet the new obligations.

Focus on Risk Management: Enhanced risk management protocols will be critical for meeting regulatory standards and maintaining investor trust.

Delegation Strategy Reevaluation: Fund managers will need to reevaluate their delegation strategies to ensure compliance with the new requirements and maintain effective oversight.

Proactive Approach

Scoping: Identifying which of the new requirements and amendments are relevant to the AIF's regulatory footprint and activities.

Gap analysis: Based on in-scope activities, perform initial analysis to identify gaps, potential actions, accountable owners, and timelines.

Product suite: Consider how the new requirements could impact on the AIF's commercial strategy, particularly regarding loan origination funds.

Reporting capabilities: Given the new information all AIFs will need to submit, start considering the technology capabilities that will be required and which function of the business will be responsible.

Conclusion

AIFMD II marks a pivotal shift in the regulatory framework governing alternative investment funds within the EU. With enhanced transparency, stricter reporting obligations, and refined delegation rules, fund managers must proactively prepare for compliance ahead of the 2026 deadline. Understanding these changes will be essential for navigating the evolving investment landscape and ensuring competitive positioning in the market.

As AIFMD II comes into effect, the emphasis on risk management and transparency will likely reshape how investment firms operate, ultimately benefiting investors and the broader financial ecosystem.