AIFMD II: Overview of the Loan Origination Regime

- Antonis Hadjicostas

- Mar 16

- 3 min read

Updated: Mar 17

Introduction

In November 2023, European institutions finalized a political agreement on a new directive aimed at amending the existing AIFMD, known as the Amending Directive. This directive was published in the official Journal in March 2024. A major challenge was establishing a framework for EU AIFMs managing AIFs involved in loan origination activities.

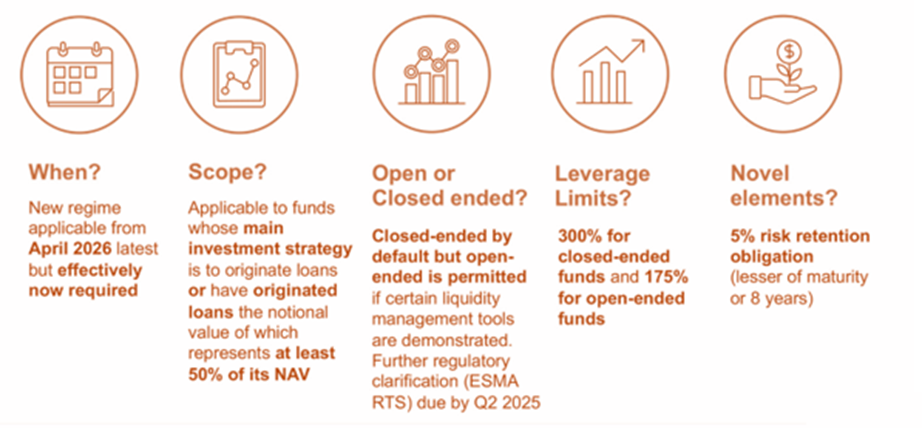

This article summarizes the key features of the loan origination regime established in the political agreement. The new regulations will take effect on April 16, 2026, and will be particularly relevant for managers of dedicated credit funds and those managing other funds that provide loans, including shareholder loans in private equity contexts.

What is a ‘Loan-Originating AIF’?

A "loan-originating AIF" is defined in Article 4 as an AIF that either:

Primarily focuses on originating loans, or

Has originated loans that account for at least 50% of its net asset value.

Loan origination is described as granting loans directly by an AIF or indirectly through third parties or special purpose vehicles, where the AIFM or AIF is involved in structuring the loan prior to exposure.

AIFMD II differentiates between an AIF engaged in loan origination and a “loan originating AIF,” which has implications for the application of various rules.

Risk Management Requirements

Policies and Procedures

AIFMs are required to implement effective policies, procedures, and processes for granting credit related to loan origination activities. If an AIFM oversees an AIF engaged in loan origination or purchasing loans from third parties, it must also manage credit risk and administer the AIF’s credit portfolio. These policies must be regularly updated and reviewed at least annually.

These requirements do not apply to shareholder loans, provided their total does not exceed 150% of the AIF's capital.

Concentration Limits

AIFMs must ensure that the total value of loans to any single borrower does not exceed 20% of the AIF’s capital if the borrower is:

A financial undertaking defined by Article 13(25) of Solvency II,

Another AIF, or

A UCITS.

This 20% limit must be adhered to as specified in the AIF’s official documents and can be extended under exceptional circumstances.

Leverage Limits

For "loan-originating AIFs," leverage must not exceed:

175% for open-ended AIFs,

300% for closed-ended AIFs.

Leverage is calculated as the ratio of the AIF’s exposure to its net asset value. Certain borrowing arrangements fully backed by investor commitments can be excluded from this calculation.

Risk Retention Requirements

To discourage quick re-sales of loans on secondary markets, AIFMs must retain 5% of the notional value of each loan they originate and subsequently transfer to third parties. Specific retention periods apply based on the nature of the loan.

Restrictions on Lending

AIFMD II prohibits AIFs from granting loans to:

The AIFM or its staff,

The depositary or its delegates,

Any entity within the AIFM’s group, unless it is a financial undertaking that exclusively finances unrelated borrowers.

Member States may also restrict AIFs from lending to consumers, as defined by the Consumer Credit Directive.

Prohibition on Originate to Distribute

AIFMs are prohibited from managing an AIF that engages in loan origination solely for the purpose of transferring those loans to third parties.

Liquidity Management Obligations

Under AIFMD II, a loan-originating AIF can only be open-ended if its AIFM demonstrates that the AIF’s liquidity risk management system aligns with its investment strategy and redemption policy. Open-ended AIFs are subject to enhanced liquidity risk management requirements, including selecting additional liquidity management tools from a specified list.

Grandfathering

The leverage limits, concentration limits, and liquidity management requirements mentioned above do not apply to preexisting AIFs until April 16, 2029, or at all if those AIFs do not raise further capital after AIFMD II takes effect.

However, if an existing AIF is already in breach of the leverage or concentration limits when AIFMD II takes effect, it must not increase its leverage or lending until April 16, 2029.

Additionally, some of the requirements relating to loan origination could apply to loans originated from April 15, 2024, if they are still in place by April 16, 2026.

Conclusion

The introduction of the loan origination regime under AIFMD II represents a significant shift in the regulatory landscape for EU AIFMs. By establishing clear definitions, risk management protocols, and obligations regarding loan origination, the directive aims to enhance transparency and stability within the financial system.

As the effective date approaches, AIFMs must ensure compliance with these new requirements to successfully navigate the evolving regulatory environment. This regime not only impacts dedicated credit funds but also influences a broader range of financial entities engaged in loan activities, underscoring the need for adaptation to these regulatory changes.