Retail Investment Strategy (RIS) - The new era of EU investors

- Antonis Hadjicostas

- Jan 1, 2025

- 3 min read

Updated: Mar 10

Overview of the Retail Investment Strategy (RIS)

The Retail Investment Strategy (RIS) was initiated by the European Commission following the Action Plan for the Capital Markets Union (CMU) adopted in September 2020. The CMU aims to enhance the financing of EU companies but recognizes challenges such as market lack of transparency, fragmentation and insufficient investment by individual investors.

Objectives of the RIS

Launched in May 2021, the RIS aims to:

Increase protection for individual investors

Enhance participation in the economy's financing

Restore investor confidence by ensuring informed decision-making

Stronger retail investments rules will give citizens the tools they need to make sound investment decisions on the EU’s capital markets at every step of their way. We need to get savings flowing into innovative European companies, including the small and medium-sized enterprises (SMEs) that are the backbone of Europe’s economy and that need to attract more private investment. These rules will contribute to deepening the capital markets union by increasing consumers’ trust in capital markets and channeling private funding into our economy.

Vincent Van Peteghem, Belgian Minister of Finance

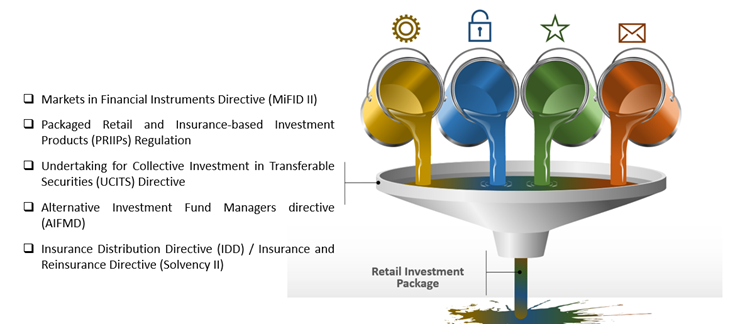

RIS Covering Framework

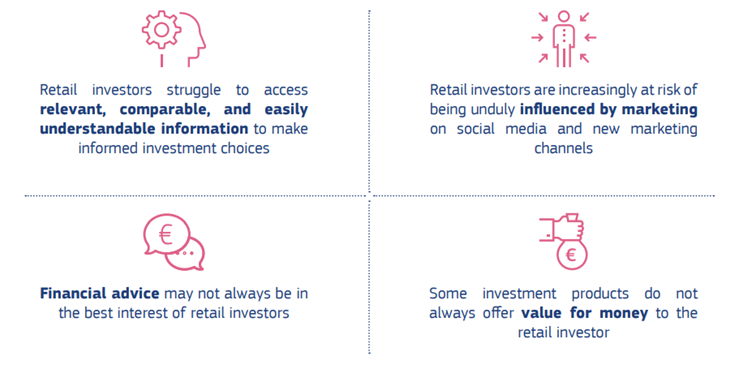

What’s the problem?

Key Features of the RIS Legislative Proposal

The RIS proposes significant legislative changes, including:

Amendments to directives: Adjustments to the Markets in Financial Instruments Directive (MiFID) and Insurance Distribution Directive (IDD) focus on investor protection, reporting, and transparency.

Strengthening product governance: A focus on ensuring a favorable quality-price ratio by controlling excessive costs and mandating benchmarks for product performance.

Regulating financial incentives: The prohibition of trailer fees for non-advisory services and enhanced transparency regarding commission payments.

Improving communication: Standardization of investor information through electronic formats and annual statements detailing costs and performance.

Suitability assessments: Stricter evaluations to ensure that products align with investors' risk profiles and preferences.

Enhancing financial literacy: Encouraging member states to promote financial education among Retail investors.

New client classification: There are new criteria for Retail investors to opt into professional clients as follows:

The criterion with respect to the client portfolio is reduced from €500.000 to €250.000.

The criterion with respect to experience has been amended to also cover clients who have ‘undertaken capital market activities'.

A new criterion is added with respect to clients with ‘recognised education or training' that supports his/her understanding of the relevant transactions /services and ability to adequately evaluate risks.

Impact for financial/investment service providers

The RIS is seen as a positive move to bolster Retail investor participation. However, concerns exist regarding potential regulatory burdens and a limited range of products, particularly affecting small investors and SMEs.

Financial players express the need for a balanced approach to avoid complicating the investment process or reducing available options for Retail investors.

The RIS directly affects various financial actors, including asset managers, insurers, and banks. It addresses products like funds, life insurance, and structured products.

Timeframes

April 2024: European Parliament votes on its position.

June 2024: EU Council adopts its position.

Q4 2024: Initiation of negotiations.

2026: Initial expected date for the RIS implementation, subject to changes based on negotiation duration.

Conclusion

The Retail Investment Strategy will bring about substantial modifications to current systems and will affect the entire retail investment experience. Additionally, as it addresses client classification, client information, and suitability considerations, there will also be implications for IT systems.